Imagine a world where your bank doesn’t just process transactions—it anticipates your needs, spots risks before they hit, and feels almost human in its responses. That’s the promise behind a fresh collaboration shaking up Pakistan’s financial scene. Today, on December 1, 2025, Wateen Telecom and The Bank of Punjab (BOP) inked a deal to create an AI Factory dedicated to turbocharging innovation in the banking sector. This isn’t just another tech partnership; it’s a bold step toward making digital banking smarter, safer, and more attuned to what customers really want.

As someone who’s watched the fintech world evolve over the years—from clunky ATMs to seamless apps—I’m excited about how this could reshape everyday banking. Let’s dive into what this means, why it matters, and how it might just put Pakistan on the global map for AI-driven finance.

Why This Partnership Feels Like a Game-Changer

At its core, this alliance marries Wateen Telecom’s deep know-how in building robust digital backbones with BOP’s laser focus on putting customers first. Picture Wateen as the architect laying down high-speed networks and cloud wizardry, while BOP brings the real-world pulse of banking—handling everything from loans to daily deposits.

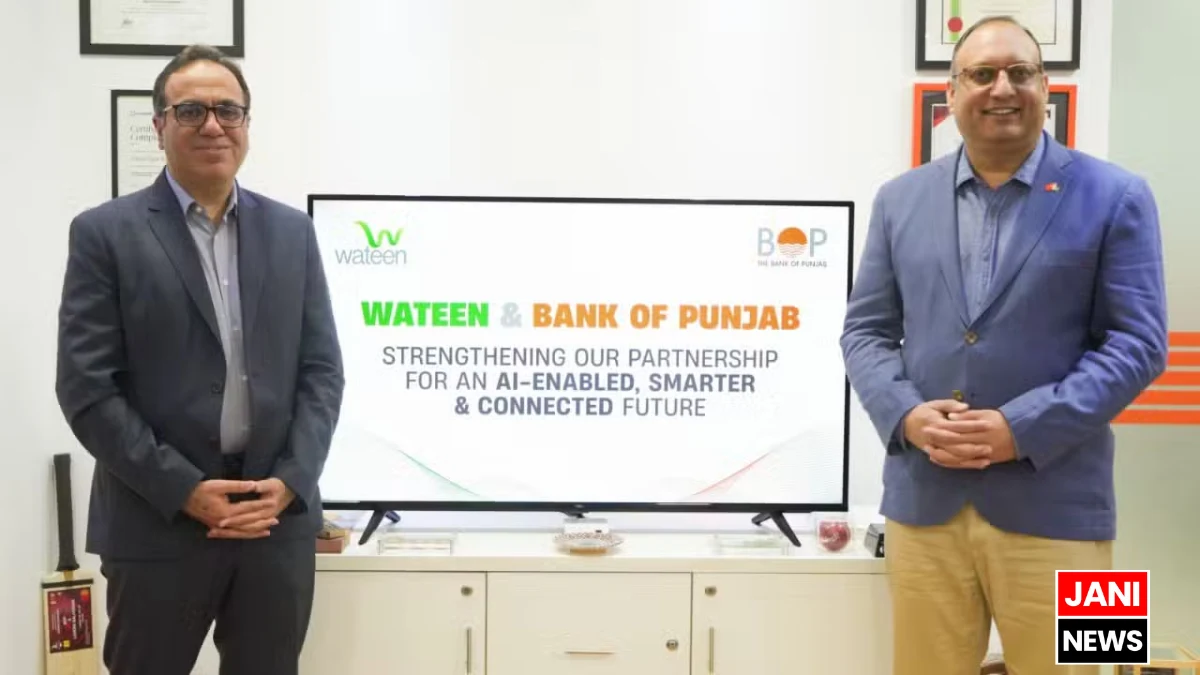

The signing happened with all the right fanfare: Adil Rashid, Wateen’s CEO, and Faisal Ejaz Khan, BOP’s Chief Information Officer, put pen to paper in a ceremony buzzing with execs from both sides. It’s more than a photo op, though. This move signals a shared dream: crafting AI ecosystems that don’t just keep up with tomorrow’s demands but help define them.

In a country where digital adoption is skyrocketing—think how UPI and mobile wallets have exploded in recent years—this factory could be the spark that ignites real transformation. According to a 2024 State Bank of Pakistan report, over 60% of adults now have bank accounts, up from 21% a decade ago. But to sustain that growth, banks need tools that go beyond basics, and that’s exactly what this initiative targets.

Inside the AI Factory: What It Promises for Banking

So, what’s cooking in this AI Factory? It’s essentially a dedicated hub for brewing up intelligent solutions tailored to the chaos and opportunity of modern finance. No more one-size-fits-all software; instead, expect custom-built systems that learn, adapt, and evolve.

Here’s a quick breakdown of the key focuses:

- Smarter Operations: Automation that cuts through red tape, speeding up everything from approvals to audits. Imagine slashing processing times by half— that’s the kind of efficiency we’re talking about.

- Deeper Customer Connections: AI that personalizes your experience, like suggesting savings plans based on your spending habits or flagging fraud in real-time. It’s banking that feels intuitive, not intrusive.

- Ironclad Security: With cyber threats on the rise (Pakistan saw a 30% uptick in financial hacks last year, per cybersecurity firm Kaspersky), these frameworks will prioritize bulletproof data protection and seamless compliance.

The beauty lies in scalability. Start small with pilot projects, then roll out nationwide. For BOP, this means evolving from a solid regional player into a tech-savvy leader. For Wateen, it’s a chance to flex its infrastructure muscles in a high-stakes arena.

And let’s not forget risk management—arguably the secret sauce. AI can sift through mountains of data to predict market dips or credit crunches, helping banks make sharper calls. It’s like having a crystal ball, but backed by algorithms instead of mysticism.

The Ripple Effects on Pakistan’s Financial Future

Zoom out a bit, and this partnership isn’t isolated—it’s woven into Pakistan’s bigger push for a digital economy. The government’s Digital Pakistan Vision aims to boost GDP by 10% through tech by 2030, and initiatives like this align perfectly. By fostering innovation-led growth, the AI Factory could create jobs in data science and AI ethics, while building trust in a sector that’s sometimes viewed with skepticism.

Think about it: When customers feel their data’s safe and services are spot-on, they’re more likely to engage. That builds loyalty, which in turn fuels economic stability. It’s a virtuous cycle, and one that could inspire other banks to jump on the AI bandwagon.

Of course, challenges lurk—training talent, ensuring ethical AI use, navigating regulations. But with heavyweights like Wateen and BOP steering the ship, I’m optimistic. They’ve got the track record: Wateen’s powered enterprise networks for years, and BOP’s digitized services to reach underserved areas.

Looking Ahead: A Smarter Banking Era on the Horizon

This AI Factory isn’t a quick fix; it’s a long-haul commitment to fortifying Pakistan’s financial backbone. As Adil Rashid put it in the announcement (paraphrasing the vibe), it’s about “empowering banks to lead, not just follow.” Faisal Ejaz Khan echoed that, highlighting how it’ll “redefine customer trust through tech.”

If you’re in banking, fintech, or just curious about where money meets machines, keep an eye on this. It could be the blueprint for how emerging markets leapfrog into the AI age—efficient, inclusive, and downright clever.

Want more insights on tech trends shaping Pakistan’s economy? Hit that subscribe button or follow us on Facebook and WhatsApp for the latest updates straight to your feed. Let’s stay connected as this story unfolds.